What Are Municipal Bonds: A Complete Guide

Oct 08, 2022 By Triston Martin

Introduction

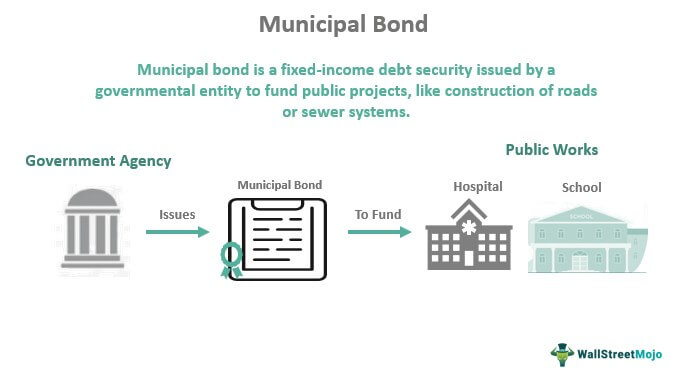

State, local, and county governments often issue bonds known as "munis" to cover ongoing expenses and fund large-scale infrastructure projects like new schools, roads, and sewer systems. Buying municipal bonds is similar to making a loan to the issuer of the bond in exchange for periodic interest payments (often semiannually) and the repayment of the initial investment (the "principal"). Its issuer may not repay the principal of a municipal bond until years after its maturity date.

Bonds with a maturity of one to three years are considered short-term, while those with a maturity of ten years or more are considered long-term. There is no need to pay income tax on the interest earned on municipal bonds. If you live in the state where the bond was issued, the interest you earn from it may also be free from state and local taxes.

Types of Municipal Bonds

Interest and principal repayment schedules are used to categorize municipal bonds. There are various structures, each with its own set of advantages and disadvantages in taxes. Municipal bonds are popular among high-income earners since their interest is exempt from federal income tax. Some municipal bonds, however, are subject to taxation. Municipal bonds can be divided into two broad categories:

General Obligation Bond

Governments can issue general obligation bonds not backed by tax income or any other specified government initiative. In this sense, the bonds are riskier but offer a higher return.

Revenue Bond

A government agency issued a revenue bond backed by the expected revenue from a specific government project. Money is collected through several means, including tolls and taxes (sales, property, etc.). However, bond yields are subject to change based on the sources' revenue levels.

What Are Some Of The Risks Of Investing In Municipal Bonds?

Buying municipal bonds is risky, but so is buying any other kind of bond. Several dangers can affect municipal bond investors.

Call Risk

A bond's call risk is its issuer's potential to repay the bond if interest rates drop, similar to how a homeowner might refinance their mortgage to take advantage of cheaper rates. When interest rates are steady or rising, bond calls occur less frequently. Many municipal bonds have call provisions that allow for early redemption, so investors who plan to keep the bond until maturity should be aware of this risk.

Credit Risk

It's possible that the bond issuer would run into financial difficulties and be unable to make timely payments of interest and principal (a situation known as "default"). Many bonds have access to credit ratings. A high bond grade is not indicative of a guarantee against default but rather an indication of the bond's relative credit risk to other bonds.

Interest Rate Risk

A bond's face value, often called its "par" value, is a constant. Bondholders who hold their investments to maturity will get the original principal plus interest, which may be paid at a fixed or variable rate. The market price of a bond may be greater than or less than its par value depending on the direction of interest rate changes relative to the bond's maturity date. It's been a while since interest rates in the United States were high. Investors who own cheap fixed-rate municipal bonds and try to sell them before they mature may incur a loss if interest rates rise.

Inflation Risk

Increases in prices across the board characterize inflation. When receiving a fixed interest rate, investors risk eroding their purchasing power due to inflation. It can also cause interest rates to rise, reducing the value of outstanding bonds on the market.

Conclusion

If you're looking to invest in municipal bonds, you should first ask whether you want to buy individual bonds, a mutual fund, or an exchange-traded fund (ETF). If the issuer doesn't go bankrupt, you stand a better chance of making money by purchasing individual bonds. When investing in bonds through a mutual fund or exchange-traded fund (ETF), however, you have a diversified portfolio and earn only the weighted average return, which will be less than the highest-yielding muni bonds.

Municipal bonds are a viable option for investors due to their low default risk and advantageous tax treatment. Remember that some risk is still involved, even with low risk. Default by cities and local governments is unlikely but not impossible. All investments are subject to uncertainty. It will help if you exercise caution before investing in anything, even municipal bonds.

Jul 03, 2023 Susan Kelly

Feb 20, 2024 Triston Martin

Feb 07, 2024 Susan Kelly

Feb 10, 2024 Susan Kelly

Mar 10, 2023 Triston Martin

Feb 06, 2024 Susan Kelly